Written By Mark E. Jeftovic, Posted on November 24, 2024

Earlier this year having digested a steep correction after the spot ETF approvals, Bitcoin put up a fresh all-time high, which was anomalous, because the halving was still coming. In past cycles new ATH’s weren’t achieved until after the halving, by a few months at least.

This time, we put up a new one (two back-to-back’s, actually) before the halving event, but pulled back right away and until fairly recently, BTC was chopping sideways in a band which Bitcoiners have been calling “chopsolidation” (could be @Checkmatey who coined that phrase).

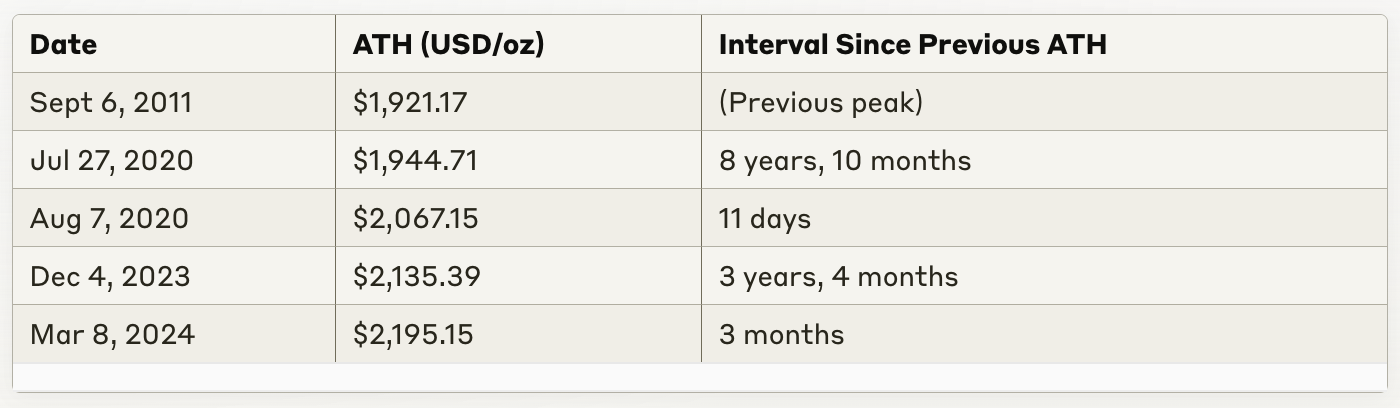

Gold, for it’s part had been demonstrating a similar pattern, albeit over longer waves. When the yellow metal notched a fresh ATH in December, 2023 I ended up looking at the dynamic over on DollarCollapse:

From gold’s 1980 high at $800/oz, it took 28 years to hit another one. Once into the post-GFC era it also struggled – each new ATH portending a possible multi-year pullback and consolidation. When gold peaked in 2011 after its post-GFC run, it marked the beginning of a decade-plus phase of “chopsolidation” for it:

It took over eight years for gold to surpass its 2011 high, and over three more years beyond that to do it again in late 2023.

In 2024, gold switched gears – putting up a successive stream of new all time highs (well over thirty time by now) and is in another undisputed bull market (and it still won’t have surpassed it’s 1980 highs in inflation adjusted terms until somewhere north of $3,000/oz).

Gold has entered “up-only” mode.

And now, seemingly catalyzed by the historic, blowout landslide the US election, Bitcoin has also gone into “up-only” mode:

After notching a fresh high immediately after the race was called, it’s been putting up fresh highs ever since, including a new one just shy of $81K USD this afternoon as I was typing this.

Clever traders, trying to time either gold or Bitcoin, may have done well to sell the tops and buy back in on the drops and for awhile that would have worked.

The problem is, if gold and Bitcoin are in secular bull markets – at some point these cyclical or sub-cyclical moves change their tempo: fresh all-time highs start coming in at shorter intervals – never mind multi-year or months-long consolidations, we end up with new highs every few weeks or days, or – given the speed crypto markets move at, every few hours.

Once that happens, we’re in “up-only” mode.

We’ve now entered up-only, both for gold and Bitcoin. Despite the animus between the “gold vs Bitcoin” crowd (as I’ve always said, I’m a “gold and Bitcoin” guy, although I’ve been weighted heavier on Bitcoin than gold for a long time).

While there previously wasn’t a lot of correlation in the past, in 2024 the correlation between Bitcoin and gold started to move a lot closer, here’s a chart using 10-week MA, admittedly there’s volatility in there (that mega gold puke after the election is a good example).

But overall, these two assets are telling us the same thing. The fiat money era is coming to a close.

A lot of people look at Bitcoin’s unprecedented run and figure they’re too late to capture the upside in this trade.

I use this phrase for a reason, because, as I have been pointing out, for years (since I published The Crypto Capitalist Manifesto), Bitcoin isn’t a trade – it’s a monetary regime change.

And the benchmark I use to gauge where we are in the process (are we early, is it too late?) is to look at the market cap of the global bond market, vs that of Bitcoin:

“Alongside these truly staggering debt levels, we have the global bond market: $120 Trillion USD (of which close to $15 Trillion actually carries a negative yield) and the M2 supply of fiat USD is somewhere in the $20T range.

To understand The Great Reset, imagine the $120 Trillion in bonds and all the M2 money supply as huge balloons, whose stems are connected to a steampunk-looking contraption that is sucking the air out of those two balloons, and pumping it out the other end into much smaller balloons, with names like “Gold” and “Bitcoin”. The last part of the analogy is to remember one thing: pay no attention to the numbers (the “nominal value”) on the Bond and M2 balloons.

What you really want to keep track of is the airflow from left to right.

That airflow is called “purchasing power”.

This is the long-term objective of The Crypto Capitalist. It is to build wealth and accumulate assets within the expanding balloons on the right side of the reset. What we are experiencing as massive asset price bubbles meets all the definitions of what the Austrian School economists call a “Crack Up Boom”.

What is different is that this is a global flight out of the balloons on the wrong side of the reset. This is, in reality, the early rumblings of a worldwide hyperinflationary event. One that will afflict all national currencies, upend the global monetary regime, displace the USD’s world reserve currency status, eliminate cash and move the entire world into a new monetary order.

Of course, in those days when I was writing the manifesto, there were close to $20 trillion is negative yielding bonds floating around against a total market cap of $100 trillion.

Now it looks like bonds are cracking the other direction – despite the Fed rate cuts, yields are breaking higher, and this is a problem for the gargantuan debt bubble.

Bitcoin is now a $1.5 trillion asset, bonds are still 100X and somewhere long the line have started being regarded as “return free risk” (Lacey Hunt’s phrase, I think). Quite simply, bonds are “dead money walking”.

I’m not saying that there’s going to be a 100% bond exodus and $120 trillion of sovereign and corporate paper are going to pile into Bitcoin.

But I can see allocators paring back their weighting, I could see 10% or 20% of bonds being shifted to other assets, and if 10% of that tries to squeeze into BTC, it pencils out to another $1.2 trillion coming in.

We’ve undergone a phase shift, where in the past, asset allocators would face real career risk by allocating to Bitcoin. It was left to maverick billionaires and eccentrics, basically people like Stan Druckenmiller, Paul Tudor Jones, or Bill Miller who either ran their own funds and already had enough clout not have to worry about answering to anybody.

Now, if you’re a fund manager, family office or a fiduciary you’re going to find yourself under the gun if you’re not allocated to Bitcoin – In the newsletter I’ve been calling it “The 1% mantra” for over a year, and we’re been seeing it play out in spades.

Now that we’re in aftermath of the Trump landslide (where it’s suddenly OK to be an Election Denialist) it is very telling to note that neither candidate ever talked about the runaway debt, ballooning deficits, let alone tackling it as part of their campaign platform.

This is the elephant in the room and nobody is addressing it, because it’s unfixable. The only course of action is to inflate away the debt, and to destroy the currency – which one? All of them.

That’s why the simple act of “getting off zero” by any amount – and then supplementing that with regular purchases (a Dollar Cost Average approach) – also in any amount, $100 a month, hell, go to a Bitcoin ATM and grab $5 a week, anything – will put you in a completely different socio-economic strata from everybody else, who won’t have any when the monetary regime change finally hits, at which point a kind of de facto Monetary Apartheid sets in.

We’re in The End Game now. For reals.

The Bitcoin Capitalist Letter provides exhaustive, deep dive coverage of the fundamental drivers behind Hyper-Bitcoinization, and maintains a portfolio stocks that best capture this historical wealth transfer – check it out here. There is also The Cryptohedge report, a digest-version of the TBC for people who just want the big picture bullet points.

Mark E. Jeftovic is the CEO of easyDNS and the publisher of Bombthrower Media. Former candidate for the federal Libertarian Party.

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.