Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

Written By Wyatt Claypool, Posted on May 9, 2022

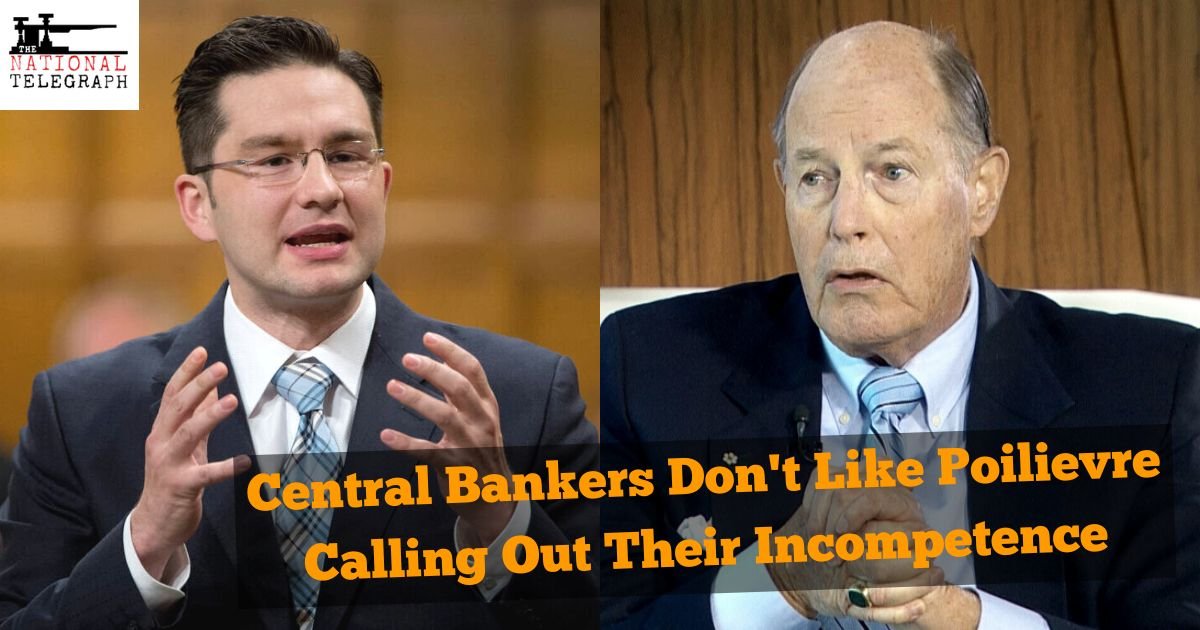

Carlton MP and Conservative Party leadership candidate Pierre Poilievre have made the issue of inflation and the management of the Bank of Canada a key focus of critique against the Liberal government ever since Justin Trudeau became Prime Minister in 2015.

During the COVID-19 pandemic, Poilievre has rightfully gone after Canada’s central bank over how much money they have been printing in order to pay for Trudeau’s massive “pandemic relief” spending, especially seen as Canada’s rate of inflation has been pushing past the Bank of Canada’s targets.

Recently Poilievre called Canada’s central bank “financially illiterate” and in response former Bank of Canada Governor (2001-2008) David Dodge attacked Poilievre, calling his assessment of the central bank “bull****”.

The @bankofcanada says #Bitcoin-ers lack financial literacy.

This from the same people who promised we’d have “deflation” right before inflation hit a 30 year high.

It is our central bank that is financially illiterate.

Restore sound money. Join, vote: https://t.co/d9I1ky9w2t https://t.co/dkdCVej1QM

— Pierre Poilievre (@PierrePoilievre) April 22, 2022

Dodge explained further, stating:

They understand what’s going on, they made a judgment call, which I think was 100% right and would have been claimed by people like Poilievre to be absolutely crazy in the spring of [2020], but it was that judgment call in the spring of [2020] that saved us from a real depression coming out of the pandemic.

Former BOC Governor David Dodge on @PierrePoilievre claims the central bank is financially illiterate: 'It's bull****.' #cdnpoli #ctvqp

Read more: https://t.co/XWh9s94tm9 pic.twitter.com/Nls4IXxAex

— CTV Question Period (@ctvqp) May 8, 2022

Dodge never explains that the “judgment call” that the Bank of Canada made in 2020 and 2021 was to print so much cash that over 1 in 5 dollars currently in circulation was printed in the last 2 years. He also conveniently leaves out the fact the economy only took the downturn because of the government keeping the economy locked up in 2020 and 2021 and instead blames COVID itself as well as the recent Russo-Ukrainian war.

M2++ = New Money Printed.

The logic backing up Dodge and the Bank of Canada’s way of thinking is that in an economic crisis the only way to stabilize the economy is by printing more cash and injecting it into the economy to stimulate artificial spending. Although this seems an appealing short-term solution when the economy is in a slump, in reality, this only prolongs the downturn in exchange for a brief uptick in economic activity.

By printing massive amounts of money the government is effectively just lowering the value of middle-class Canadian’s savings while driving up the price of goods, meaning people will be incentivized to buy cheaper products, or fewer products, leading to a chronically slow economy

We all know WEF’s lieberal/NDP puppets are taking Canadians Country away lying all the way. Unless we stand up together very soon